Retail finance workshop: The low-cost alternative to discounting

Posted on in Business News, Cycles News

Summer is the perfect time to start offering your customers finance, with sales typically reaching their peak in June and July. But that doesn't mean to say finance should be neglected for the rest of the year. In the first of a series of retail finance workshops, the ACT discuss how retailers can use Ride it away retail finance as the perfect alternative to discounting all year round.

Summer is the perfect time to start offering your customers finance, with sales typically reaching their peak in June and July. But that doesn't mean to say finance should be neglected for the rest of the year. In the first of a series of retail finance workshops, the ACT discuss how retailers can use Ride it away retail finance as the perfect alternative to discounting all year round.

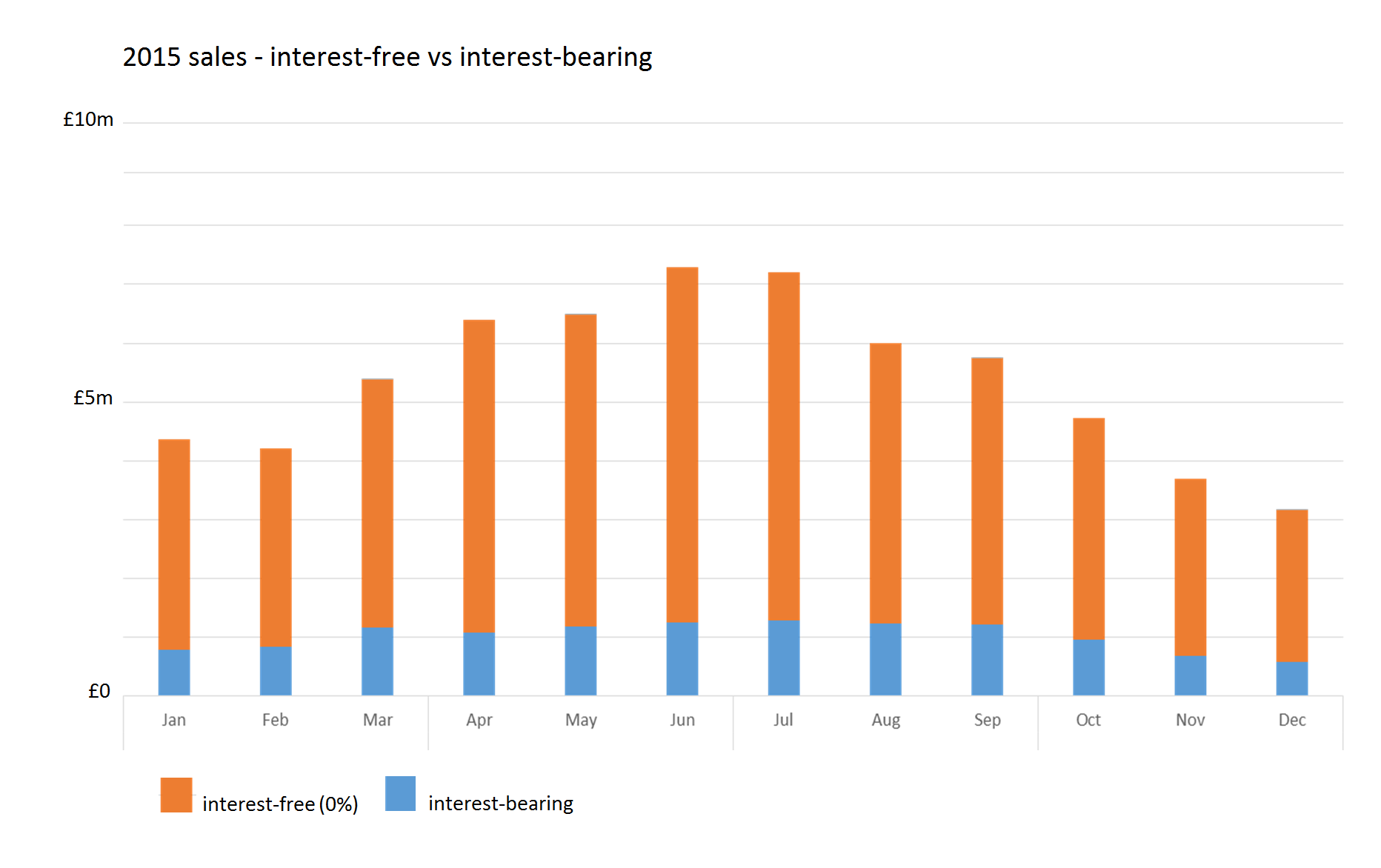

Thanks to the warmer weather June is a key month for bike retailers, so it's no surprise that it is also the highest grossing month of the year for Ride it away sales. In fact, June 2015 sales were the highest ever, with almost £8million worth of financed sales in the one month alone and with sales already up 20% vs same period in 2015, this summer looks set to break records once again.

However, once summer comes to a close and end of season stock needs shifting many retailers reduce the number of bikes they sell on finance, instead preferring to rely purely on discounting.

But even with end of line goods, retail finance options are still an attractive prospect for customers, making the products even more affordable by allowing them to spread the cost. So why aren't more retailers seeing the potential of utilising finance all year round?

Protecting margins

Many retailers fear eating into their margins by paying finance subsidy fees, but when compared to discounting, retail finance can actually be a very low-cost sales tool - without having to devalue brands and encourage customers to expect price cuts.

Many retailers fear eating into their margins by paying finance subsidy fees, but when compared to discounting, retail finance can actually be a very low-cost sales tool - without having to devalue brands and encourage customers to expect price cuts.

Discounting is often used as the go-to technique to shift end of line stock, but how often are margins considered before a discount sticker is put on a product? Say a product retails at £100 and from that a retailer makes £20 profit. Putting a 10% discount on that product reduces the price to £90, and the profit to just £10 - a 50% decrease in profit.

When used properly, retail finance can mean not having to make that loss.

Offering interest free (0%) finance up to 12 months is a great way to get started (since it's free to set up and has no additional costs in the form of FCA authorisation), but this does incur a higher subsidy cost than interest bearing options.

Alongside 0% finance, retailers should be offering 4.9%, 9.9% and 15.9% APR options with 6-48 month terms, giving them the ability to choose the best finance option to suit the customer, product and even time of year.

A 15.9% APR for the customer is comparable to the rate charged by many credit cards and carries no cost to the shop on 24-48 month terms - a win-win for both customer and retailer. Plus, with finance the advertised APR is just a headline rate, so the customer won't actually pay 15.9% of the loan amount in interest, i.e. a £1000 loan over 12 months with 15.9% APR will not incur £159 of interest, but rather just a little over £82 as the value of the loan decreases with each months payment.

In order to offer more than just interest free credit, retailers will need FCA authorisation, costing just £100 (with periodic fees from just £145p.a.).

Your most powerful sales tool

The other advantage of having interest bearing options available is the ability to upsell whilst still sticking to a customer's monthly budget. By knowing how much a customer can afford per month retailers can flex finance to work for them.

Assuming a customer has a monthly budget of £50, without FCA authorisation the retailer is limited to 0% over 12 months which means the most expensive bike that can be sold is around £700. However if given the option of 24 months at 9.9% APR, the customers total budget increases to around £1200 - yet the difference in the subsidy cost for the retailer is just £5 more!

Customers may be used to seeing 0% finance options in-store, but most are willing to pay interest in exchange for the ability to spread the cost. In fact, a consumer survey found that 57% of consumers who made a purchase on finance, did so purely because the option to pay in instalments was available, regardless of the APR.

Despite this, interest bearing finance sales accounted for just 19% of total Ride it away sales in 2015, but if used correctly this could be the most powerful sales tool for your shop.

Once summer 2016 is over, don't let your retail finance sales fall flat. Get FCA authorised today and let Ride it away boost your sales all year round.

To find out more visit www.rideitaway.biz or contact the ACT on 01273 427 700 or info@theact.org.uk.

Useful links

If you have any other queries please contact us.